What is the eMPF Platform?

The Mandatory Provident Fund (MPF) System came into effect in 2000. Currently, there are 13 MPF trustees offering 27 MPF schemes to about 4.5 million scheme members and 10 million MPF accounts. More than 65% of the 30 million MPF administration transactions per year are paper-based, and the lack of a standardized and centralized administration platform, leading to a higher amount of administration fees.

To streamline, standardize and automate the existing MPF scheme administration processes, the Government and the Mandatory Provident Fund Schemes Authority (MPFA) are pressing ahead to develop the eMPF Platform. The eMPF Platform will serve as a one-stop electronic platform for employers, employees and scheme members to manage their MPF accounts across different MPF schemes anytime and anywhere, as well as to reduce paper work and human errors.

The eMPF Platform is the most significant reform of the MPF System since its establishment. Through adoption of the platform, it could drive greater operational efficiency, create room for fee reduction and enhance user experience. In the first two years after the implementation of the eMPF Platform, an average reduction of about 30% in the scheme administration fees payable by scheme members is expected. The Platform is estimated to achieve cumulative administration cost savings of $30 billion to $40 billion over a 10-year period.

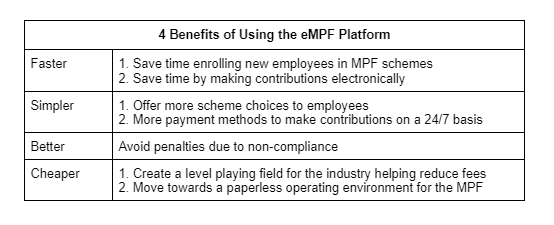

4 Benefits of Using the eMPF Platform

(Source: MPFA)

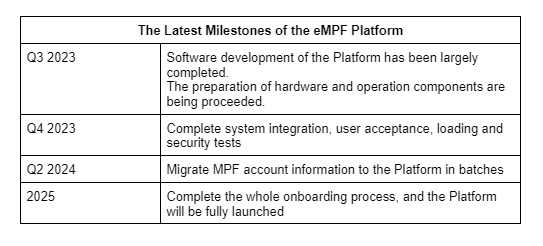

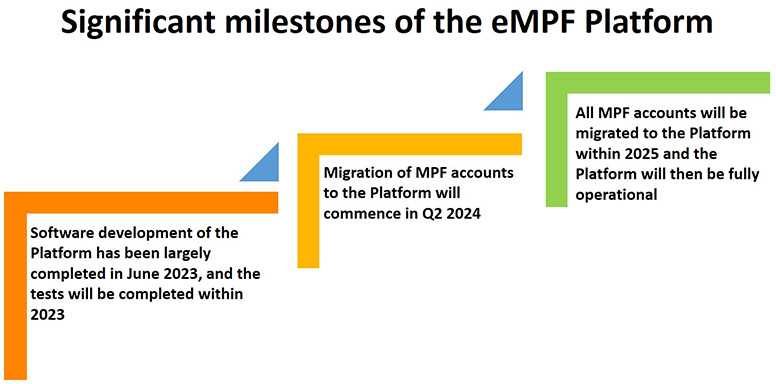

The Latest Milestones of the eMPF Platform

The migration of MPF account information to the Platform is expected to commence in the second quarter of 2023, and the MPFA aims to complete the onboarding of all MPF schemes within 2025 and make the Platform fully functional in the same year. The milestones of the eMPF Platform are as follows:

(Photo source: MPFA)

After completing the construction of the eMPF Platform and all the related tests, the first batch of MPF trustees (i.e. the five early adopters) including YF Life Trustees Limited, China Life Trustees Limited, Bank of Communications Trustee Limited, Standard Chartered Trustee (Hong Kong) Limited and Bank of East Asia (Trustees) Limited will migrate the accounts of their MPF schemes one by one to the Platform starting in the second quarter of 2024. The accounts under the remaining schemes will then get onboard in accordance with ascending order of the value of assets under management by trustees.

How Employers Can Benefit from the eMPF Platform?

There are 330,000 participating employers in the MPF schemes, involving cumbersome administration processes and a high volume of paper-based transactions. According to the MPFA, they issued payments notices to over 200,000 employers who had delayed or defaulted on contributions, resulting in $60 million in surcharges.

The eMPF Platform will replace the current cumbersome enrolment procedure such as filling and signing paper forms, manual submission and checking of documents. Enrolment in MPF schemes and contributions will be made electronically via the Platform, driving greater operational efficiency. Employers will receive reminders of MPF contributions submission, helping them avoid the imposition of contribution surcharge due to failure to pay the contributions punctually. Moreover, the Platform can also help calculate MPF contributions automatically to prevent inadvertent delay or default contributions due to human errors that would result in contribution surcharge. Employers can review contribution and transaction history anytime.

Some employers are concerned that the support services of the eMPF Platform would be insufficient, the MPFA claimed that hotlines and outreach teams will be set up to help employers and employees address problems while using the Platform.

(Source: HKET)

For employers that are using a HR software and a payroll system concern if their systems can integrate with the eMPF Platform, the MPFA and the project contractor had organized various briefings for HR and payroll software providers on how HR software solutions and payroll systems could integrate with the eMPF Platform, with a view to ensuring a smooth transition to the Platform for all users. Employers could contact their HR software provider for further information.

Seamless Integration with FlexSystem Human Resources Management and Payroll Software

As a leading provider of Human Resources Management and Payroll Software (HRMS), FlexSystem is enhancing our software with updates and new features for seamless integration with the eMPF Platform in the future.

Our Human Resources Management and Payroll Software and Cloud HRMS accelerate the digital transformation of your business through automating the HR processes like payroll, rostering, attendance and leave management to save time and costs, helping you create a competitive advantage.

Contact us to request a demo to experience our comprehensive HR and Payroll System: https://www.flex.hk/fesa-human-resources/